How to Save Money Fast On A Low Income Every Month (We Saved $30,000!)

In 2013 my husband (then fiance) and I scrambled to save money fast for some upcoming bills. Our wedding, a down payment on our house, school loans, and my brand new car weighed on our shoulders.

But guess what?! We did quickly save money and paid off all these things within our first year of marriage. The total debt we paid off in 2013 – 2014 was more than $30,000!

It’s amazing what a little frugal planning can do when you determine to save money fast.

Even when you’re living on a low income, it’s possible to pull through and come out with more than enough to cover your bills and necessities like we did.

We foster relationships with brands we use and trust. The testimonials on our site represent real experiences, but they don’t guarantee you’ll achieve similar results. When you make purchases through our links to our partners, we may earn a commission. Your support helps us continue this work. You can read our full disclosure here.

35 Ways to Save Money Fast When Living on a Low Income

Your mindset can change the future. What is more important to you: short term pleasures (the here and now), or long term financial security, and having everything you need?

To me, the answer is obvious. But many people forget that there are ramifications for having a short term mindset.

Where will you be in 10, 30, or 50 years? How much money will you have saved up in this amount of time? You’ll need to envision your future before understanding how to save money fast, and why it’s important.

So with a long-term mindset, let’s dive right into a short-term plan to save money fast on a low income!

These actionable tips to save money fast are easy, straightforward, and honest ways to live a comfortable life. Use these ideas to make the most of what little income you have!

Related: Money Questions to Ask Your Partner

Use Cash Back Apps to Save on Autopilot

Every time you shop online and at your local grocery store, you could be earning cash back. So many people ignore these legitimate apps and end up losing out on these free money hacks.

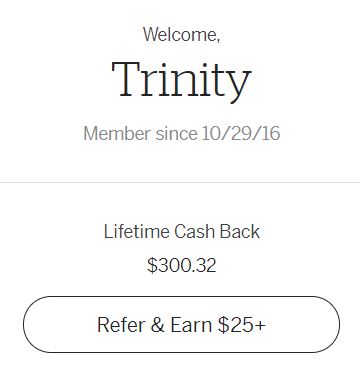

1. Rakuten

Rakuten has quickly earned the status of the best cash back app for online shopping. It allows you to earn money every time you place an eligible online purchase. If you already use cash back credit cards, you can double dip by using Rakuten, too.

It works like this: you sign up here for a free Rakuten account, browse the site for the stores you already shop at like Target, Walmart, Best Buy, and hundreds of others, then click the store link to open a shopping trip. You’ll shop directly on the store of your choice’s website as normal! Once you spend $20 within 90 days of becoming a new member, you’ll get a $20 bonus (FREE money).

Some stores offer small cash back percentages, while others like Walmart offer up to 10% at times. That’s no small amount if you already regularly shop at Walmart.

Related: 5 Easy Ways To Save Money Shopping With Rakuten [Full Review]

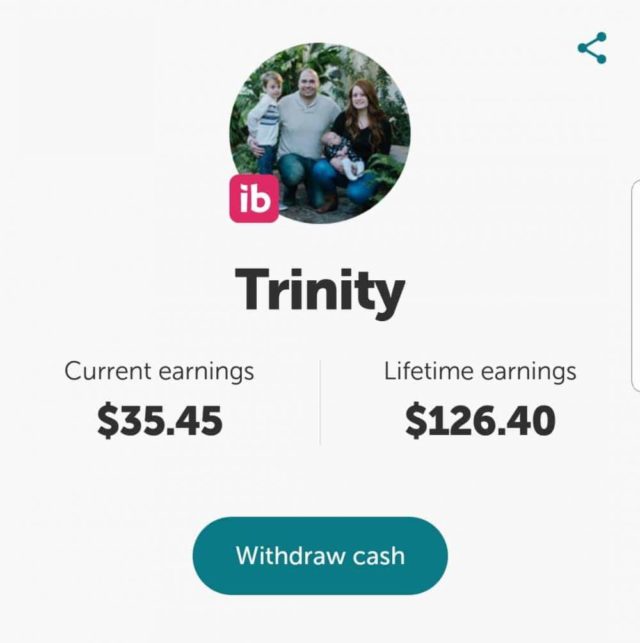

2. Ibotta

If you buy groceries, then Ibotta is the best money-saving app to have on your smartphone. Since most people preplan for grocers, it’s easy to pull up the Ibotta app and preselect the offers that match your grocery list. A quick scan through the current cash back offers could help you save month each month. Download the Ibotta app to start saving money!

Related: Is Ibotta Legit? Read My Full Review

3. MyPoints

Similar to Rakuten, MyPoints offers cash back on all kinds of online purchases. The nice thing about having multiple cash back apps is that you can earn money on more purchases. Get a $5 bonus for signing up with MyPoints.

4. Swagbucks

Swagbucks and MyPoints are owned by the same parent company, but they offer unique cash back offers at any given time. You can cash out your earnings when you reach just $3 in your account. Plus, like the other sites, Swagbucks awards you a $10 bonus to sign up and shop like you normally would.

If you’re interested, check out these other ways to make money using Swagbucks. You can earn extra cash just for searching the web, watching tv, and playing games on your phone.

5. Raise Discounted Gift Cards

A little known trick to save money on tons of everyday purchases is by purchasing discounted gift cards from Raise and using them for necessities. Store availability varies, but you can set up alerts for gift cards to the stores that you patronize often.

You can even stack your savings by purchasing discounted Raise gift cards with your credit card (earning you points) and then turn around to use your gift card online through Rakuten (earning you cash back). And don’t forget the discount you earned by using a Raise gift card.

Related: Ibotta vs Rakuten: Can You Use Both Cash Back Apps?

Use Smart Money-Saving Tools

To save money fast, start with these smart tools. Since they are readily available and work, what do you have to lose?

6. Acorns

Acorns is an investment app that allows you to round your purchases up to the nearest dollar and invest the increase. I have been using Acorns for only a short time and already I’ve racked up a lot of money in my account!

Investing extra pennies (or quarters) into an interest-bearing account is a simple way to save money fast. You won’t even notice the difference when the money is taken from your bank account or credit card and placed into an investment account.

If you mainly use cash for purchases, you can place all one and five dollar bills into savings to achieve the same goal. Using Acorns, however, helps you invest your money and earn interest in the meantime.

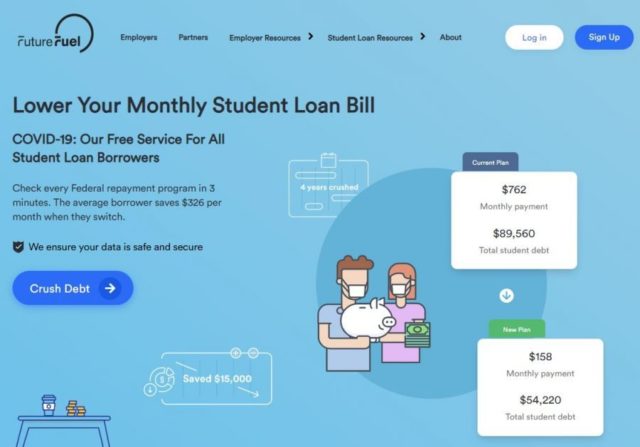

7. FutureFuel.io

FutureFuel can help you save thousands of dollars on your student debt. The company’s mission is to introduce a new way to offer student loan debt benefits. They proudly proclaim: “In partnership with employers, we are revealing a new path to prosperity and a (student) debt-free America.”

You can connect your student loans to the company for free and they will assess different ways to shave hundreds if not thousands off of the total debt you pay. People save an average of $326 per month using FutureFuel.

Related: FutureFuel.Io Review: How Much Can It Save You On Student Loans?

8. Blooom

If you have existing retirement savings, connect them to Blooom for a free analysis of the health of your accounts. The company can assess your current accounts and give you ways to maximize your savings. Remember, saving money is not just about today; it’s about your future. Connect your accounts to Bloom to start saving money fast.

9. Trim

Since most recurring bills are on autopay these days, it’s easy to forget which subscriptions you’re paying for each month. And when you do pay for necessary bills on autopay, you forgo the opportunity to negotiate your bills lower. Lowering just one bill, like your internet subscription, could save you $20 or more per month. Imagine how much money you could save if you negotiated all of them today!

Trim is a company that negotiates all of your bills and cancels unused subscriptions (with your permission) on your behalf. Savings like these can add up to hundreds per month back into your pocket.

10. Coupons

Printing coupons from Coupons.com can save you a lot of money as you shop. Additionally, you can subscribe to receive the newspaper with coupons in the mail or ask a friend or family member if you can go through their coupons after they’ve had a chance to look through them. For a few months, I visited my local post office and requested a stack of free newspapers (with coupons) before they were recycled.

Checking out with a pile of paper coupons is definitely not my favorite thing to do, and you can often find the same or better deals with an app like Ibotta.

Additionally, InboxDollars is a website that pays you up to $.25 per day to download, print, and use physical coupons. And that doesn’t include the amount you’ll save by using the coupons. Get a $5 bonus when you sign up for a free InboxDollars account.

Don’t forget that you can stack coupons with digital cash back opportunties. It’s one of the best ways to save money fast and put it straight back into your budget.

Related: 100+ Best Online Shopping Sites in the USA to Get Great Deals

Switch to a Different Company (to Save Instantly)

For some reason, most people have brand preferences without even realizing it. If you can break out of your normal routine and switch some of your services, you can end up saving a lot of money.

11. Switch Cellphone Plans

In 2013, my husband and I switched our cellphones to Republic Wireless and stayed there for a few years. We loved how cheap the plans were. The only reason we switched to Verizon is because we were able to pay a similarly low price on a large family plan. Unfortunately, individuals and even small families will pay a lot of money per month on a Verizon plan.

What’s unique about Republic Wireless is that your phone can automatically switch from using data to using wifi to place calls and access the internet. This can save you money each month. If you have an internet connection at home, work, and most other places you go, then you could pay as little as $15 to $20 per month per phone.

The only thing we didn’t love about Republic Wireless was that we didn’t get cell service during our occasional visits to Canada (we live in the US). We could, however, connect to wifi and use the phones perfectly that way. Otherwise, Republic Wireless saved us tons of money while we paid down debt.

12. Switch to Clean Energy

You can save money and help save the planet by switching to clean energy through a company like Arcadia Power. It takes just two minutes to check the availability in your area and connect your existing utility account if it is. Whether you own a home or rent an apartment doesn’t matter. As long as you pay the utility bill, Arcadia can save you money fast.

13. Switch to Google Nest

If you’re not in a position to spend some money in order to save more in the long run, then skip this tip now.

Last year I switched to a Google Nest Thermostat and will never go back to the old fashioned thermostats most people still use. Why? Because our Nest saves us a lot of money.

The first way to save money fast with a Nest is to turn on the learning function. This allows the smart device to learn and adapt to your heating and cooling preferences. Then, over a span of time, the Nest adjusts to the temperatures you want at the times you prefer. In other words, if you don’t mind the house being cool overnight, the Nest will comfortably drop the temperature and increase it when you wake up.

The other function that helps Nest users save money is the Home/Away Assist. You can instantly switch to Eco mode when leaving home, or the device will automatically switch when you’ve been gone for a set amount of time. You can also sync your phone’s location with the device and it can determine if you’re home or away at all times. During this Eco mode, the Nest adjusts your temperature to use less energy. You can even pull up the app on your phone at any time if you need to adjust the temperature remotely.

There are other ways to save money by switching to the Nest. You’ll have opportunities to participate in rebates and rewards depending on your location and energy usage. Overall, you can save a lot of money every month without lifting a finger when you switch to a smart thermostat like Nest.

14. Switch Your Lender or Refinance Your Loans

Refinancing your student loans could save you thousands of dollars. If you have outstanding student loans or other types of loans, then you know all too well the reality of interest rates.

Review your rates and check our your refinance options with LendKey. Just a slight decrease in interest rates can lower your monthly payment. This puts more money in your pocket each month and helps you to save extra money quickly.

Even a lowered interest rate with the same monthly payment will save money (think long term savings).

15. Switch Car Insurance Companies

Don’t get comfortable paying more to your insurance company than necessary. You can possibly save a lot of money per month by switching to a comparable plan that costs less per month. Get a new competitive quote from Insurify to see how much money you can save. The lower your monthly payment, the more money you can put toward saving for a house, your kids’ education, or a special occasion.

Related: Best Time to Buy New Tires

16. Switch to Airbnb

For most people, taking a vacation is necessary. It doesn’t need to be an elaborate trip to Hawaii or an all-inclusive cruise to the Bahamas, but a simple stay in an affordable Airbnb can save you tons of money. Airbnb is a company that facilitates peer-to-peer rentals of homes, apartments, and single rooms. You can often schedule a week’s vacation in a full home for a fraction of the price you’d pay for a hotel. And the amenities in a home are far more flexible.

Related: How To Get Free Airbnb Stays (Plus Make Money In The Process)

17. Switch to an Online Bank Account

When my son was born in 2015, my husband decided to start a cash fund – he religiously placed all of his coins, $1s and $5s in a container to save it for our son. The savings quickly grew and we knew we needed to get this money into an account to avoid letting it lose value due to inflation.

If you place $3,000 into a high yield savings account that pays 2.15% APY (compounded monthly) and deposit $100 per month into the account for 15 years, you’ll save $25,359.69.

However, if you instead stash $100 in cash at home, then you’d save a flat $21,000 total in the next 15 years.

Simply opening a high yield savings account and saving the same amount of money, in the same amount of time, can help you save an additional $4,359.69 over the next 15 years.

Not only that – but saving money in a bank is safer than potentially having the cash stolen, burned in a house fire, or simply losing value due to inflation.

18. Switch Your Flights

If you travel for work or just have an upcoming vacation, you can save tons of money using a site like Scott’s Cheap Flights. The website prominently displays that members save an average of $550 per flight ticket! That is a huge amount on a single ticket, and that’s just the average. You could end up saving even more. So next time you need to travel, get on Scott’s email list so that you can be the first to hear of amazing flight deals.

Related: 10 Cheap Housing Alternatives

Check Your Eating and Drinking Habits

It’s easy to let your daily eating habits go unchecked, especially when it comes to drive-thrus and takeout. But This could be one area that could help you save money each month.

19. Make Your Coffee at Home

If you’re anything like me, you need your morning coffee. With the hustle and bustle of everyday life, it is often more appealing to hit the drive-through than to brew at home.

Those frequent trips to Starbucks, Dunkin Donuts, or a variety of other caffeine avenues begin to hurt your budget. The average person at Starbucks spends around $4.50 per transaction. Add that up to three to five times per week, and you’re spending about $20 a week and $80 a month!

If you consider yourself a coffee connoisseur and haven’t found the perfect grounds to replace your Starbucks habit, try new brands on Amazon. Once you find a delicious alternative to Starbucks, you can save so much money. If you don’t even know if your coffee maker still works, you can grab a cheap one and the coffee will still taste fresh.

Or maybe a nice Espresso maker is the only thing that will curb your daily coffee shop stop. Whether you go big or go cheap, you will save money daily by brewing your own coffee.

20. Bring Your Lunch and Breakfast to Work

I’ve worked a 9-5 job in an area where fast food and takeout was almost unavoidable. Even the $6 to $10 lunches add up to $50 a week or $200 a month in expenditures.

Put money back into your budget by committing to bring your breakfast and lunch from home. Take the time on weekends to meal-prep. This will allow you to have fresh and great-tasting food, but without the high price tag of eating on-the-go.

We always have some ridiculously handy meal prep containers on hand so that I can send my husband out the door with some yummy leftovers for lunch!

21. Eat Out One Fewer Meal Per Week

After a hard day of work, it’s so easy to grab take-out for the family to enjoy. For a family of three, those take out meals can be up to $25 – $30 at a time. It may be difficult to cut back on take-out or even excessive date nights. But what if you committed to cutting out one takeout or restaurant meal each week? That would save you $120 this month.

Related: How to Move Out at 18 and Afford It

Save On Groceries

The next time you go to the grocery store, read through your receipt. Take an inventory of the things you bought on last week’s trip. Did you cook that package of chicken breasts that were on sale? Is that bag of potato chips even opened yet? The fact is that we often buy more than we need at the grocery store. Simply taking an inventory of the items you buy can help you identify things that you don’t need.

22. Buy in Bulk

Whether or not you have a large family, it usually pays to buy in bulk. If you’re on a tight, week-by-week budget, then you might not be able to go out and buy everything in bulk tomorrow, but if you plan ahead, you can save a lot of money this way.

For example, you might find that peanut butter is on buy 1 get 1 half off sale but you don’t need peanut butter until next month. If you can plan ahead for sales like these and train yourself to watch for them, you can really save money if you buy more than one food item of the same type at a time.

23. Buy Store Brand

If you need to save money fast, try to venture away from name-brand items; get to know your store’s brand. You may not be able to buy store-brand everything but start testing the waters.

Over the years, we’ve found certain store-brand foods that we enjoy just as much as the name brand items. You can save a lot of money on groceries when you purchase store brand as often as possible.

24. Visit More than One Grocery Store

As a child, I was slightly bitter at my mom for dragging my siblings and me to more than one grocery store when she took us shopping with her. Now I understand why she chose to shop at more than one grocery store in the same day.

If you get too comfortable shopping at one store, you fail to keep that store honest with their pricing. Shopping for the lowest prices at different stores helps drive prices back down when they start to get out of line.

25. Meal Plan

You might wonder how meal planning plays a part in saving money on groceries, but bear with me – it does!

If you go to the store without a few days worth of meals planned, then you will end up purchasing groceries that go to waste. More often than not, you probably find yourself using up the bits and pieces of food before it goes to waste, but you won’t need to scramble to make that happen if you plan your meals ahead for the week.

26. Get Accustomed to Chicken

For many, meat is the biggest expense when grocery shopping. Meat is something that most families don’t want to go without.

To avoid overspending on meats, try experimenting with the cheaper options in your area. Chicken is our go-to meal when we’re trying not to spend too much money.

If it’s the same for you, then start researching chicken recipes. You might find some fantastic meal ideas that will keep the family from complaining because you’re serving chicken three meals in a row.

27. Make a List

Believe it or not, having a grocery list in hand while you shop can save you money (and time). By having a prewritten checklist, you’re ensuring that you stick to your allotted budget for that shopping trip.

Having a list goes hand in hand with meal planning for the week. Make sure to do both at the same time to make your life easier.

28. Eat Before You Shop

It may sound like a funny way to save money, but make sure to have a snack (or meal) before you go grocery shopping. It’s easy to walk out of the grocery store with far more groceries than you need, just because you were hungry.

It’s much easier to stay on track with your grocery list when you’ve eaten before heading out to shop.

Related: How to Get Paid to Shop

Other Ways to Save Money Fast

There are tons of ways to save money when you’re willing to make small changes. Here are some other favorites that add up to big savings over time.

29. Pay Your Bills Yearly

Paying bills on a yearly schedule is not as difficult as you think. It just takes a little extra budgeting and research to see which bills can be lowered by paying them yearly.

Contact all of your utilities, streaming services, TV and internet providers, insurance companies and other bill companies to ask if they offer discounts for making larger payments.

For example, my local PO box has the option to be billed monthly, bi-yearly or yearly. The longer I reserve and pay for my PO box ahead of time, the more I save in the long run. Do this for every bill possible and the savings add up.

Of course, committing to larger payments can be difficult at first. Most companies will work with you to set the recurring bill date to match your fund availability.

Calculate all of your yearly bills and mix/match them to balance out your yearly payment schedule. For example, pay the yearly cable bill in January, the internet bill in February, the phone bill in March, and so on.

Only negotiate a yearly (or bi-yearly) payment with companies who will extend a discount.

30. Cut Your Cable

Major cable companies are struggling because millions of customers have dropped cable recently. You may have signed up for an introductory rate, and now find yourself in the midst of a $100 – $150 monthly bill.

With so many online platforms available like Amazon Prime, Netflix, Hulu, YouTube TV, and Sling, there is no reason for such high cable bills. After all, can you really say you watch all 1,000 channels you have in your listing?

Take the time to review your monthly bill and consider when you can get out of your cable contract. Also research alternatives and the services they provide. It might surprise you that cutting the cable cord could put more than $100 a month back into your budget.

31. Request Partial Refunds on Recent Purchases

Retailers often refund partial payments on an item when there is a price drop. But most online shoppers forget to take advantage of this fact and request a refund.

I like to use Paribus to check for price changes on my recent purchases. It will scan your email and locate digital receipts.

Paribus will then contact the retailer on your behalf to request a partial refund.

If you shop online often, I highly recommend this company! Otherwise, you could be wasting hundreds of dollars per year.

32. Create a Budget

If you haven’t started budgeting your income and expenses yet, then you need to start. If you don’t know exactly what is coming into and leaving your accounts, then you won’t know how to save the most money.

For my family budget, I use a mobile app called Mint. Intuit (creator of TurboTax and QuickBooks) established Mint to record and categorize transactions.

Mint is free, easy to use, and accurate. Each month I get updates reminding me when we are nearing our family budget limits in various categories.

I’m embarrassed to say that the very first month that I used Mint, I learned that we spent over $700 that month on food. For two adults and one small child, yikes! We found ourselves eating out far too often because it was easier than making food at home.

Thankfully it was not a trend but it was definitely an eye-opener!

If you would prefer to put your budget on paper, check out my free budgeting templates.

Having a budget has been a lifesaver for my family when it comes to saving money fast. We’ve pinpointed plenty of purchases that we can weed out to save more.

33. Commit to Give Up One Thing

Budgeting is only half of the uphill battle. After creating and reviewing your budget, commit to giving up one luxury each month. Here are some ideas:

- Eating out

- Movies

- Streaming services

- TV services

- Gym memberships and personal trainers (but still workout at home!)

- Unneeded “wants” from the store

- Coffee on the run

Consider choosing an unnecessary expense from your budget that you spend the most on. Put this exact amount aside into savings. This will help you save money fast!

34. Go Paperless at Home

You could save between $120 to $225 per month by going paperless. When you’re on a tight budget, that amount could add some padding back into your wallet. Doing this could help you save an extra $1,440 to $2,700 every single year.

Here are some paper products you can eliminate (and how much it can save you to do so):

- Paper towels – save $9 to $20 per month – alternative: unpaper towels or cloths

- Paper plates, cups and napkins – save $19 to $24 per month – alternative: glass dishes, cups, and cloth napkins

- Baby wipes – save $6 to $15 per month – alternative: washcloths

- Disinfectant wipes – save $4 to 8 per month – alternative: disinfectant spray and unpaper towels or cloths

- Feminine products – save $10 per month – alternative: Thinx reusable underwear

- Tissues – save $2 – $3 per month – alternative: handkerchiefs

- Coffee filters – save $0.25 per month – alternative: French Press

- Paper bills – save $5 per month – alternative: paperless billing

- Paper money – save $40 – $100 per month – alternative: use credit cards and earn points/cash back

- Notepads, notebooks, sticky notes, printer paper, index cards, stationery, etc. – save $1 to $5 per month – alternative: whiteboards and chalkboards

- Books – $5 – $10 per month – alternative: Kindle

35. Shop Second Hand

Not everything you need can be purchased second hand. Groceries, hygiene supplies, and OTC medicine are a few examples that always need to be purchased brand new. But there are many categories of items that we often forget to consider purchasing second hand.

A few types of items you can consider purchasing second hand are clothes, shoes, toys, books, large appliances, electronics, furniture, etc. There are many places that you can purchase second-hand items today for a great deal such as thrift stores, garage sales, eBay, and Facebook Marketplace.

Next time you need to purchase a pricey item, research your second-hand options! You can save tons of money quickly by shopping second hand.

Being Frugal Can Help You Save Money Fast

The ultimate way to save money on a low income is to remember that you have a low income and you have responsibilities that need to be met. Always prioritize needs above wants and it will help you save money that didn’t need to be spent. It’s a mindset that once established, could stay with you for life.

These simple money-saving ideas only scratch the surface of frugal living. For my husband and me, simple fixes like these allow us to save some money each month.

Take your savings goals in strides. Start by saving money each day until you are saving money each week. In time, you will be saving money each month!

Gaining momentum in your savings can help you get the most out of your monthly budget. The result? More money in your pocket and hopefully more peace of mind.

We now know how to save money each month. It’s the actual doing that we need to work on every day!