FutureFuel.io Review: How It Saves You Money on School Loans

What would you do with extra cash put back in your pocket each month? Because that’s what FutureFuel.io claims to do for those who hold student loans.

I enjoy saving money just as much as making money these days, because it’s like double-dipping into the financial pot. When you make an extra $300 and save $300 in one month, that’s a total of $600 more in your budget. For some people, that’s huge!

Let’s acknowledge for just a moment how hard it can be to save money. The bills come at the same time every month, yet sometimes it just doesn’t seem like there is enough to put towards savings.

Couponing and cutting out the extras in grocery shopping are great ways to help you save. However, are they enough to help you get out of debt?

Especially that pesky student loan debt!

Does this sound like you? It certainly sounds like me. Considering my student loans and having to configure them into my monthly expenses makes me grit my teeth each time. The amount that I could be saving just in the interest alone is appalling.

Thankfully, there is a way to help you get your student loans under control. It’s a company called FutureFuel.io and it promises to help you start the account you need to start saving money on your student loans.

We foster relationships with brands we use and trust. The testimonials on our site represent real experiences, but they don’t guarantee you’ll achieve similar results. When you make purchases through our links to our partners, we may earn a commission. Your support helps us continue this work. You can read our full disclosure here.

What is FutureFuel.io and is it Legit?

The first thing that came to my mind when I heard of this firm was, “Is FutureFuel.io a scam?” It’s true; I find it challenging to trust a company that is new. So, I did some research.

FutureFuel.io offers a variety of services when it comes to student loans. These services range from refinancing loans to consolidating loans and interest reduction.

The mission of FutureFuel.io: “In partnership with employers, we are revealing a new path to prosperity and a (student) debt-free America.”

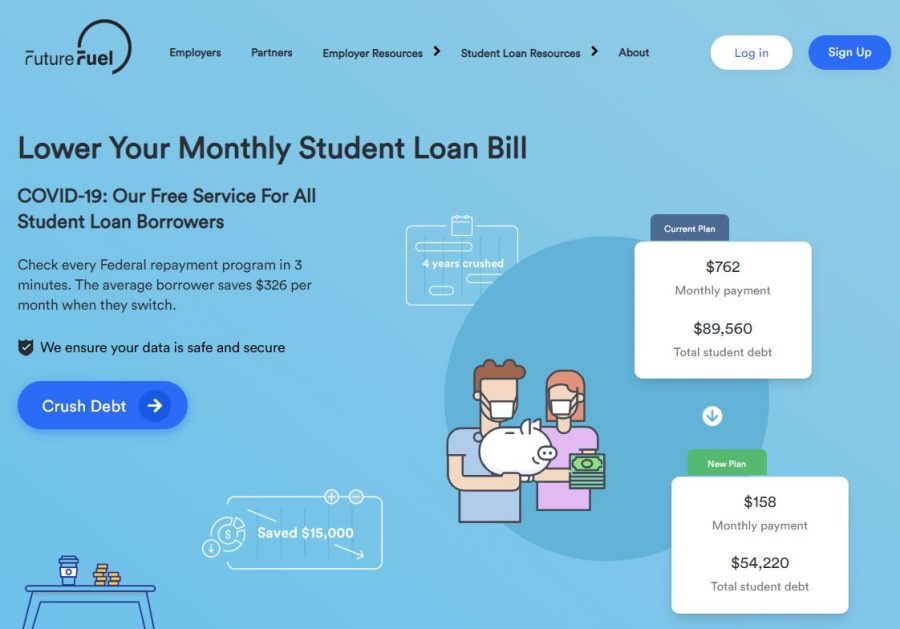

When switching to FutureFuel.io, the average borrower saves $326 per month. I don’t know about you, but saving nearly $4,000 a year sounds like a plan to me. What could you do with the extra savings?

Related: How to Get Paid to Go to School

Pros of FutureFuel.io:

- Futuristic goals in mind;

- Can help with the current student loan debt crisis in the United States;

- Desires to assist customers with getting out of debt in the best way possible.

Cons of FutureFuel.io:

- Small company that is still learning to navigate the ins and outs of their business and continuously implementing active change.

Related: How to Move Out at 18

How Does FutureFuel.io Work?

By first connecting your student loans to FutureFuel.io, you can then establish what kind of repayment option works best for you and your budget.

To make it even easier to track, you can download FutureFuel.io’s app and see all your loans in one place. It even helps you choose where to direct those extra funds in your wallet.

1. Sign up for a free account and connect your loans

Signing up for an account is easy, quick, and free to do. You’ll be asked to fill in five boxes: first name, last name, email, phone number, and create a password.

Next, you must agree to their terms and privacy policy. Then click ‘Sign Up’ and you’ll be taken to your dashboard where you can connect your loans to start saving. Click on the ‘Crush Debt’ button to begin connecting.

Related: PINCHme Review: How To Get Free Samples To Review And Keep

2. Take advantage of FutureFuel.io’s money saving features

When you look at your statement from your student loan account, do you notice the small section where it shows you how much interest you are accruing each month?

This interest rate is typically a high amount and makes paying off your student loan debt even more challenging. Basically, your loan amount goes up each month and the payments you make go towards interest first before going to your principal balance. Unfair, right?

Paying off your student loan sooner rather than later can save you thousands of dollars in the long run. FutureFuel.io has many features you can look into to help you get on the path to paying off your loan faster to save you money.

RoundUp: This feature from FutureFuel lets you pay down your debt by using your spare change. Like Acorns, FutureFuel rounds up the change to the nearest dollar on purchases you make. Remember, the interest is paid first before the principal balance so the more you can pay now, the less you’ll pay in interest later.

Reassess: Find out the right repayment plan for you from income-based repayment plans to public service loan forgiveness.

Giveback: With purchases made by customers, FutureFuel has partnered with over 450 brands to give back to the community by paying back a portion of your student loan debt. Install the Google Chrome extension for free and every time you make a purchase using one of the brands, up to 30% cash back is applied to your student debt.

Refinance: Get pre-qualified from 10 lenders in minutes without hurting your credit score.

Roll Up: Roll Up is another feature offered by FutureFuel allowing you to manage all of your student loans in one place. This includes private and federal loans on one screen.

Related: Rakuten Review: Can You Realy Earn Cash Back While Shopping?

3. Check out additional resources to save on student loans

FutureFuel.io is dedicated to your savings and the future of our economy. Check out their resources on their blog where you can find information about loans for bad credit, student loan forgiveness, and refinancing reviews for 2020.

Related: 10 Cheap Ways to Live

How Do I Know if FutureFuel.io is Right for Me?

We are all trying different ways to save money each month to help us meet our long term goals, find financial stability, and be free of as much debt as possible. All of the ways to save money are possible, but the biggest money hog is hands down student loans.

Convinced yet to join FutureFuel.io? It doesn’t hurt to try to see all your options when it comes to student loan financing and how you can save money for your future. The next step in your decision-making process is to sign up with FutureFuel and activate the RoundUp feature. Then, check out the options to refinance and save even more money on your loan interest.

Knowledge is power. The more knowledge you have about your repayment options, the more power you have when it comes to paying back with an option that is right for you.

Related: When Is the Best Time to Buy Tires (to Save the Most Money)?